DeFi trends and how Fuerte fits in

It's time to finally introduce Fuerte – a community-driven DeFi asset management aggregator.

We have recently published two articles on basis trading and Squeeth. Now, it’s time to introduce Fuerte itself – our vision, mission, and plans.

Fuerte is a community-driven asset management aggregator. We will talk about it in the second part of this article. Let’s start with some of the trends that DeFi space has witnessed and how Fuerte positions itself for the future.

DeFi trends

DeFi is a new industry, and like any other emerging industry, it is going through stages of development. Some of these trends are not really unique to DeFi, with the first being aggregation.

Aggregation

Let’s start by looking at TradFi as a proxy. Legacy TradFi from a user standpoint requires interaction with many providers each of whom is offering only a limited number of services. In this legacy system, an average person would have a credit card with Wells Fargo, insurance from Prudential, a brokerage account with TD Ameritrade, and would send money abroad via Western Union. Each company stores the data and makes sure it doesn’t leak to competitors.

Needless to say, it’s a poor user experience – that’s why VCs have been pouring hundreds of billions of dollars into fintech, and as a result, companies like Revolut and N21 are now providing all these services at once at a much lower cost. The concept of open banking implies data sharing between financial institutions and fintech companies through APIs, so users can get better financial products.

In crypto, interoperability is granted (at least, within one chain), and all the data is publicly available, so we can bypass permissions and associated regulation – the main challenges for open banking. It is in our power to combine different protocols and products in all ways possible to achieve the payoffs that users desire.

This leads to the question:

Why does every DeFi project needs to have a separate app where it would offer one service?

More mature sectors within DeFi, such as the money market and exchanges, have been through aggregation for quite some time. Platforms like Yearn are aggregating and optimizing lending yields, while 1inch and its competitors do the same for swaps. It turns out that by swapping on 1inch a user always gets the same or better price as by swapping directly on Uniswap, so there is no point in going directly on uniswap.org for swaps, not taking gas fees into account.

Sustainable asset management is a much less mature subsector than exchanges and lending. That is because the basic infrastructure such as lending, spot exchanges, derivatives, etc., had to be built to enable asset management in the first place. You can think of it as a transition from Uni v2 that allowed mostly basic LP strategies to Uni v3 whose potential is still to be fully discovered. Now that the infrastructure is there, we have a wide range of possibilities to build strategies on top of it, much beyond supplying liquidity to Curve or Compound.

Community-first approach

Community in web-3 projects can’t be overestimated. Community = users = tokenholders = people that participate in the project and care about its future. In the case of Fuerte, the community is probably even more important as we rely on it as a primary source of strategies in the long run. Our aim is to attract defi enthusiasts with diverse expertise such as finance and coding and provide the right set of incentives for them to participate in strategy development. And, of course, to promote a meritocracy of ideas culture within our community – only in this case, we can ensure the long-term success of the platform.

Integrations & DAO to DAO interaction

Interoperability is cool as it allows different projects to build on top of each other without asking permission. But it’s even cooler when communities and projects work together – by solving issues the industry has, we push it forward. 2021 became a year of a new phenomenon – DAO to DAO interaction. We have witnessed M&As (Gnosis & xDai, Fei & Rari), swaps of treasury assets, Curve wars, and so forth.

Asset management protocols have really two key metrics – liquidity of their token and TVL (also volume for exchanges). The former is an issue as liquidity incentives are costly, so there are several projects that are working on solutions – protocol-owned liquidity by Olympus Pro, Liquidity-as-a-Service by Ondo & Fei, and Tokemak’s liquidity events. The latter is much less on the agenda.

By talking to existing DeFi projects, we got to realize that everyone is seeking integrations with other projects that will help to increase TVL. It served as validation of our idea.

Fuerte in a nutshell

As mentioned earlier, Fuerte is a community-driven asset management aggregator. Let’s decompose it:

Community-driven as we rely on the community as a primary source of the strategies in the long run. We are also seeking ways to be DAO-centric from day one.

Asset management includes a wide range of strategies – active and passive, delta-neutral and directional, risk-averse and riskier.

Aggregator – we will focus on the integration of existing defi strategies on Fuerte, in addition to those developed by the community and the core team. The ultimate goal is to become a one-stop shop for defi asset management.

Value proposition

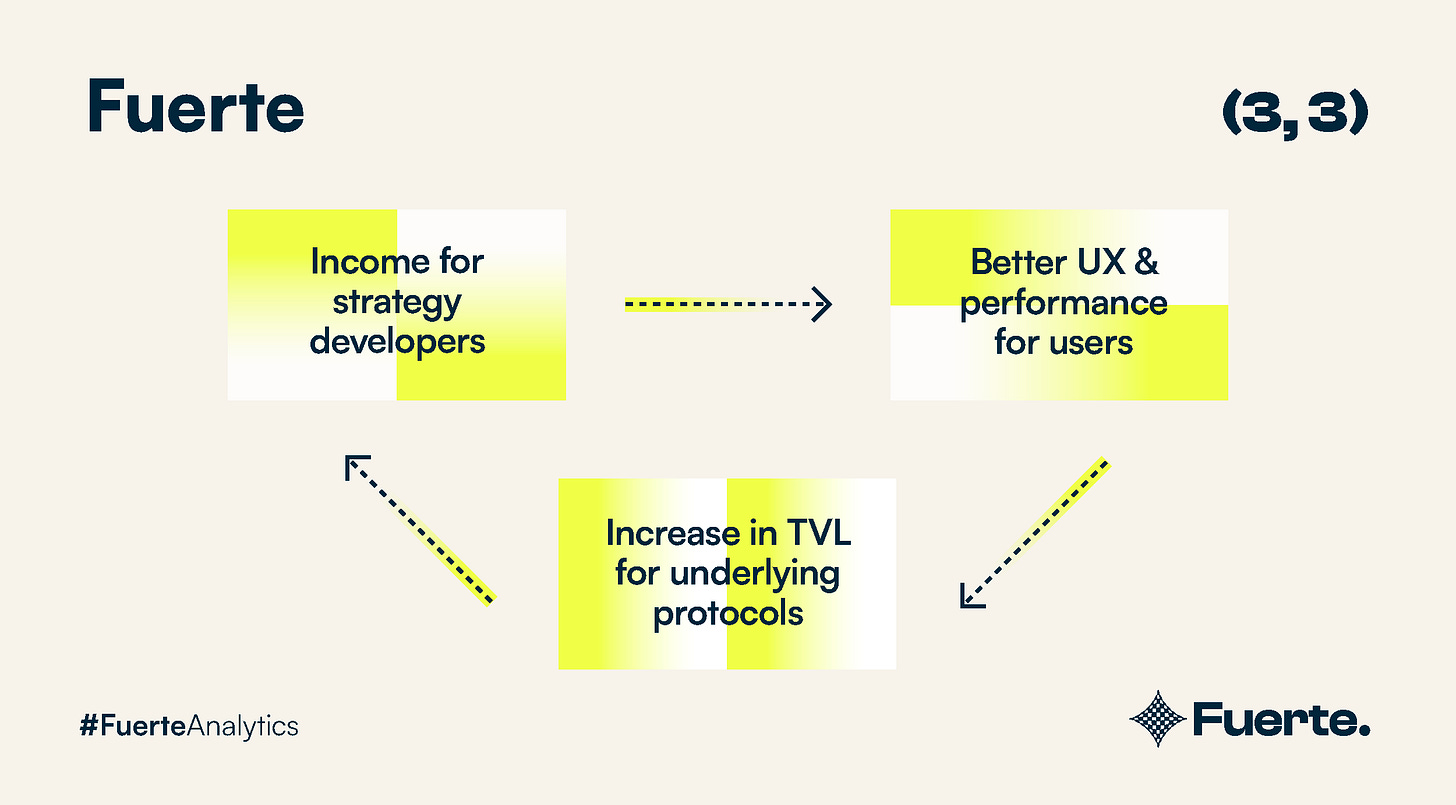

We want to grow the pie, so Fuerte’s design is totally (3, 3).

DeFi enthusiasts get motivated to develop and publish their strategies on Fuerte by management/performance fees & potentially other incentives →

As the variety and quality of strategies goes up, user experience and returns improve →

An increase in Fuerte’s TVL leads to an increase in TVL of underlying protocols. As TVL increases, it attracts even more strategists.

Strategy sourcing

We want Fuerte to be as open as possible to anyone willing to build the future of asset management. We distinguish three groups that have different (though sometimes overlapping) incentives:

Core team - our mission is to bootstrap the strategy development by being the first to list strategies on Fuerte, build the community, and incentivize its members to develop strategies. Down the line, the core team will be just yet another strategy developer on the platform.

Community - expected to develop and list strategies driven by monetary incentives such as performance and management fees, among others.

DeFi protocols - may list strategies utilizing their underlying smart contracts infrastructure to bootstrap TVL and awareness. They might choose not to charge management/performance fees or even incentivize strategies with their native tokens.

Focus & next steps

Our list of priorities over the coming weeks includes three main points:

Strategies

We, the core team, are most excited about derivatives and see great opportunities there as the space is growing quickly with new products being launched almost every week. Some of them are not just interesting products but new defi primitives, such as Squeeth and Primitive. These products can be naturally packaged in vaults, and we see a lot of opportunities focusing on them.

Another focus is a basis trade strategy on top of Perpetual Protocol, which will start to develop as soon as Perpetual Protocol will have a testnet for multi-collateralization, which is likely the end of Q1.

Our plan is to make the first strategy available for deposits in the coming weeks. We will publish research and backtests alongside the strategy.

Community & awareness

As a vibrant community is a key success factor for the project, we will continue to produce content as one of the ways to attract people. While we have a small community yet, some members have already shown interest in developing strategies. We will be also adding information about Fuerte such as a litepaper and FAQ to the website to increase awareness.

If you are interested in defi, derivatives, or just want to keep an eye on the project, follow us on Twitter and slide in our Discord to not miss anything interesting.

Interaction with defi projects

We have already spoken to a few projects that we are considering building on, and all of them were interested in collaboration and offered assistance.

A couple suggested we apply for their grant programs, which we are now considering.